INFRASTRUCTURE TECHNOLOGY INVESTMENT OPPORTUNITY

A Disruptive Technology Solving the Largest Problem in Pipeline Infrastructure

Highlights

- Disrupting ~$1B market with limited competitive options

- Traction: 430+ installed to date. Won prestigious 2021 innovation award

- Intellectual Property: 2 patents issued & several pending. $3+M spent in R&D

- >50% Gross Margin Projected: Better function, lower cost & faster lead time than competitors

- Experienced Team: 120+ combined years in pipeline construction & corrosion protection

LPS technology solves the largest problem for many of the world’s pipelines: how to protect the interior of welded pipe joints from corrosion. After lengthy tests and trials, our products are being installed and client inquiries are streaming in.

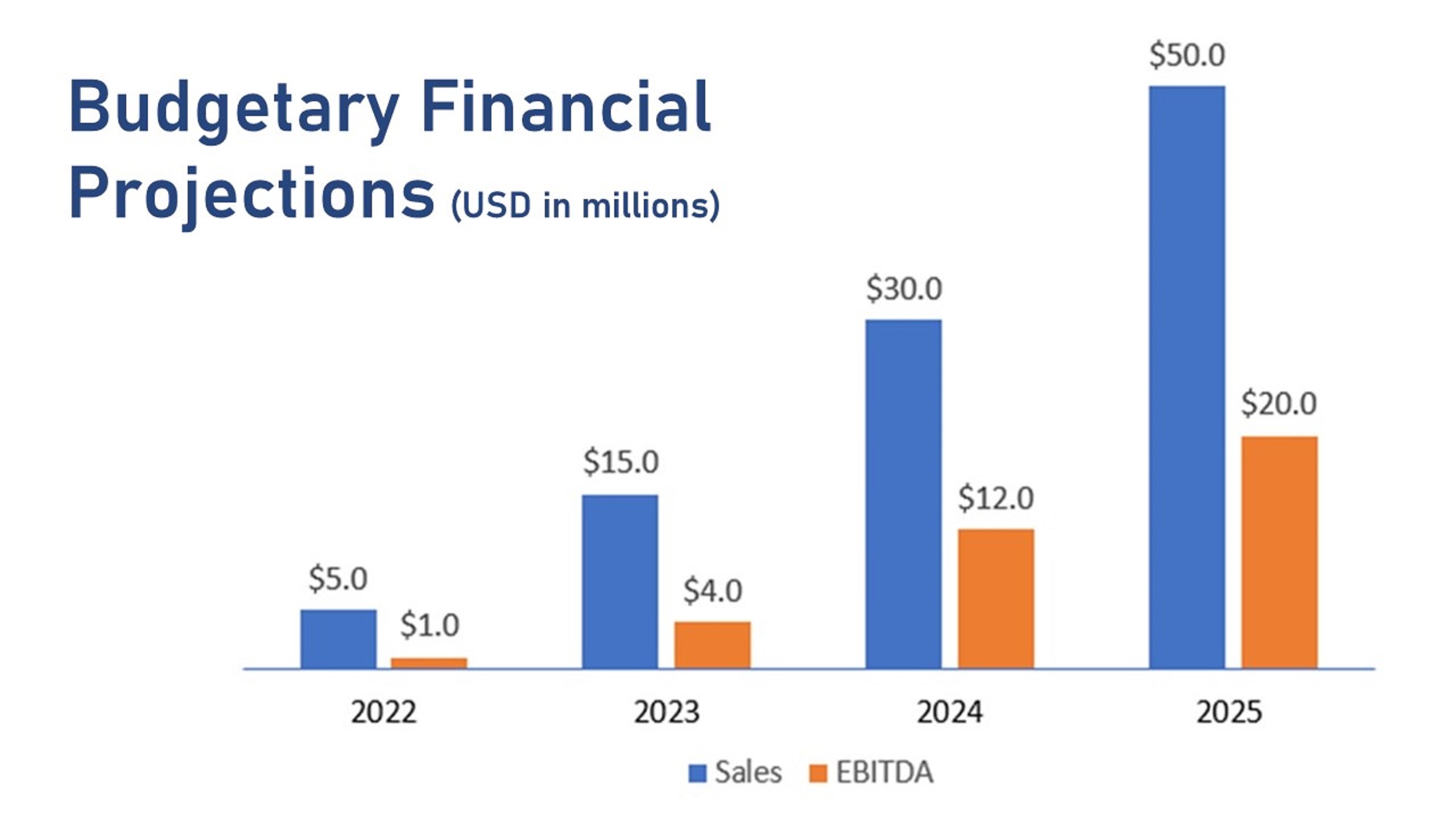

We are starting a Series B fundraising round to scale manufacturing capacity and build our team ahead of expected rapid growth.

This is a unique stage to invest in LPS: The advantages of the technology and large hole in the market have never been in question. But we needed to prove the product was easy to install and functioned well. That box has been checked and now it’s just a matter of time before LPS technology is widely adopted.

Big Market, Big Problem, Few Solutions

Internal corrosion is the largest problem in pipeline infrastructure, and LPS technology permanently solves the problem for significantly less cost than other less-effective solutions.

Low Investment Risk

LPS technology has been successfully installed in more than 400 pipeline joints and has passed tests required by water agencies and oil companies. The lack of other good solutions means that LPS technology will quickly gain more traction.

Green Technology

LPS technology makes pipelines last. Not only does it help prevent leaks but it prevents the need for pipeline replacement, an unnecessary yet all too common contributor to carbon emissions and local environmental disruption.

Low Current Valuation

Long sales cycle and approval process for pipelines means current revenue does not reflect the actual stage of LPS technology nor the amount of serious client inquiries.

Large Valuation Increase Imminent

Valuation will skyrocket once first multi-million dollar project is won because many more pipelines in need of a better solution will follow suit. ROI of 10X – 20X is likely within 3 years.

Massive Growth Opportunity

Almost every pipeline in the world is the market. LPS technology permits lowest total construction cost (by a large margin in most cases) and will quickly take market share from established companies.

Schedule a call to answer your questions and learn more about this investment opportunity.

Investor Qualifications

Sophisticated or Accredited Investors are welcome.

“Sophisticated Investors” need to warrant that they have sufficient knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of the investment.

“Accredited Investor” means generally the following:

an individual

whose annual income in the previous 2 years exceeds $200k (or $300k jointly with spouse) and who reasonably expects the same for the current year, OR

whose net worth is over $1m (individually or jointly with spouse) excluding primary residence, OR

who is a director or executive officer of LPS (i.e., presently, Ryan, Anisio, Marian), OR

who is a licensed broker-dealer or investment adviser or knowledgeable employee of an investment fund or has another credential recognized by the SEC, OR

an entity

whose assets exceed $5m (subject to certain exceptions), OR

whose owners are all accredited investors, OR

that is a specific type recognized by the regulations (e.g, financial institution, broker-dealer, investment company, etc.)

DISCLAIMER

This presentation is not an offer or solicitation and is only intended for the recipient to whom the LPS (the Company) delivered it too. The financial projections are preliminary and subject to change; the Company undertakes no obligation to update or revise these forward–looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Inevitably, some assumptions will not materialize, and unanticipated events and circumstances may affect the ultimate financial results. Projections are inherently subject to substantial and numerous uncertainties and to a wide variety of significant business, economic and competitive risks, and the assumptions underlying the projections may be inaccurate in any material respect. Therefore, the actual results achieved may vary significantly from the forecasts, and the variations may be material. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. These projections should not be considered a comprehensive representation of the Company’s cash generation performance. These financial statements are not audited and are not based on any audited financials.